5 projects in LNG to watch in 2019 - part 2

For part 1 of this article, click here

Project 1: Rovuma LNG - Mozambique

Last year ended with a surprise announcement from ExxonMobil. The Area 4 co-venture participants had secured sufficient LNG offtake commitments for the Rovuma LNG project (more than 85 trillion cubic feet of natural gas) to move towards FID in early 2019 with production expected in 2024.

The project partners are ‘Mozambique Rovuma Venture’, a joint venture between ExxonMobil, Italy’s Eni and China’s CNPC with a 70% interest; and Empresa Nacional de Hidrocarbonetos, South Korea’s Kogas and Portugal’s Galp with 10% each respectively. A direct competitor for Rovuma LNG is Anadarko’s Area 1 project in Mozambique, which we featured in our report last year. Anadarko is targeting FID in 2019, which means, with huge natural gas reserves and two major LNG projects, Mozambique could be a major LNG exporter in the coming decades.

Source: Gastech Insights

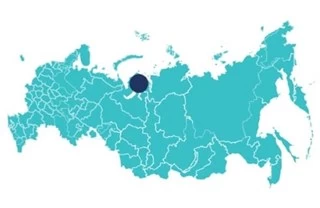

Project 2: Arctic LNG-2 - Russia

Backed by Russia’s largest independent natural gas producer and LNG operator, Novatek, Arctic LNG-2 is the second of Novatek’s LNG plants on the Yamal and Gydan Peninsula. The first, Yamal-LNG, started production in December 2017 and Novatek succeeded in bringing Yamal LNG Trains 2 and 3 online ahead of schedule - in July 2018 and November 2018, respectively. Like Yamal LNG, Arctic LNG-2 production will be delivered to international markets by a fleet of ice-class LNG carriers that will be able to use the Northern Sea Route for cargoes destined for Asia. The 19.8 mmtpa Arctic LNG-2 project will be located offshore near the remote Gydan Peninsula in northern West Siberia with plans to build an LNG plant on three gravity-based structures (GBS) in the Ob Bay, designed by Saipem. The final investment decision on Arctic LNG-2 is expected in 2019, with plans to start up the first train by end 2023. For more details on Arctic LNG-2 and Yamal, see page 23 of the March 2019 Valve World magazine.

Source: Gastech Insights

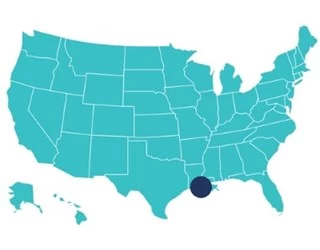

Project 3: Calcasieu Pass - USA

Venture Global’s Calcasieu Pass LNG export project is located in southern Louisiana. The 10 MTPA facility will employ a process solution from GE Oil & Gas, now part of Baker Hughes, that utilises mid-scale, modular, factory-fabricated liquefaction trains. Kiewit was awarded the EPC contract in December 2018 and construction is expected to begin in early 2019 following the receipt of all regulatory approvals. The project is tentatively scheduled to begin operations in 2022. Venture Global is also developing a second LNG project in Louisiana, Plaquemines LNG, located about 20 miles south of the Port of New Orleans and is in the process of selling capacity and hopes to take FID at the end of 2019.

Source: Gastech Insights

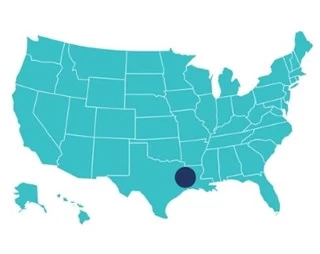

Project 4: Driftwood LNG - USA

Tellurian is targeting FID in 2019 with the Driftwood LNG project, having modified their business model from 2018 to attract investors. Whereas most of the second wave of US LNG projects are trying to secure longterm contracts from off-takers, Tellurian is seeking equity partners. Last year the minimum buy-in was $1,500/ton or $1.5 billion, however, in their recent offering, this has been lowered to $500/ton or $500 million. Project debt will increase from $3.5 as originally proposed to approximately $20 billion, and the LNG cost delivered FOB will be $4.50/ MMBtu ($3/MMBtu for feed gas and liquefaction and $1.50/MMBtu for debt servicing) up from $3/MMBtu. Tellurian is working on proving out the commercial viability of its model and reportedly they are on a “short-list” of projects being considered by Saudi Aramco, which is looking to take an equity stake in a US LNG export project.

Source: Gastech Insights

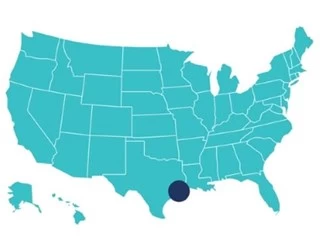

Project 5: Sabine Pass Train 6 - USA

In February 2016, Cheniere became the first US LNG exporter in the continental US when it shipped the first cargo from its Sabine Pass facility located in Louisiana. Cheniere is developing up to six trains at the Sabine Pass LNG export site, each capable of producing 4.5 million tonnes per year. Sabine Pass Trains 1 through 4 are operational, Train 5 is undergoing commissioning, and Train 6 is being commercialized and has all necessary regulatory approvals in place, including approval by the US Department of Energy and US FERC. In November 2018, Cheniere announced that it had finalized the EPC contract with Bechtel for Sabine Pass Train 6 and was releasing Bechtel to commence early EPC activities for Train 6 ahead of making a final investment decision.

Source: Gastech Insights

+86 512 68781993

+86 512 68781993