Special Research on the Titanium Industry (Part I): The Origin, Applications, and Current Status of the "Universal Metal" (Part 2)

Special Research on the Titanium Industry (Part I): The Origin, Applications, and Current Status of the "Universal Metal" (Part 2)

Reserves Overview

As a B381 F2 gate valve factory, we closely monitor the availability of titanium due to its significance in high-performance applications. Titanium is abundantly available on Earth, with a crustal abundance of 0.61%, making it more prevalent than commonly used metals such as copper, nickel, tin, lead, and zinc. While over 140 types of titanium-bearing minerals have been identified, only a dozen or so are currently of commercial mining value. Titanium ore deposits are generally categorized into two main types: hard rock deposits and placer (sand) deposits.

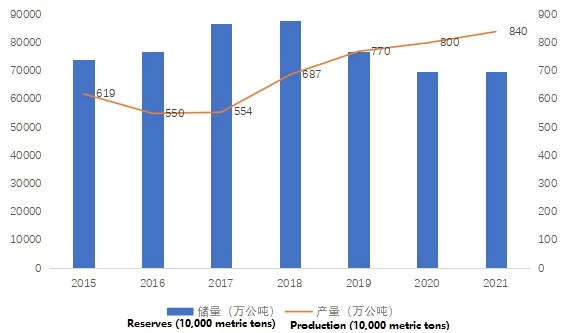

According to data from the U.S. Geological Survey, the global titanium ore reserves have shown a trend of rising initially and then declining. In 2012, global reserves reached 650 million tons, and the discovered reserves continued to increase, peaking at 880 million tons in 2018. However, with a significant surge in titanium production in 2019, the global reserves saw a decline for the first time, falling to 700 million tons in 2020.

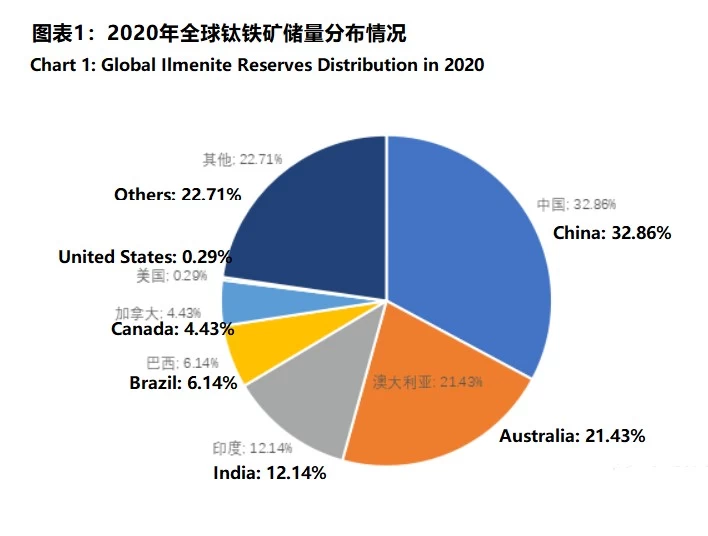

More than 30 countries worldwide possess titanium resources. However, the primary deposits are concentrated in Australia, South Africa, Canada, China, and India. These countries have different types of titanium ore: Canada, China, and India primarily have hard rock deposits; Australia and the United States are rich in placer deposits; and South Africa is abundant in both types. Among them, China holds the largest reserves of ilmenite, totaling 230 million tons—approximately 32.86% of the global reserves—followed by Australia with 150 million tons, accounting for 21.43% of global reserves.

Data Source: United States Geological Survey | Collated by Mengersi

In terms of production, there was a significant increase in global ilmenite output starting in 2019, mainly driven by a sharp rise in production in China. This surge was attributed to the global manufacturing industry's shift toward China and the rapid development of China's titanium application market. Additionally, the end of the China-U.S. trade tensions further contributed to the growth in ilmenite production.

Chart 2: Global Ilmenite Reserves and Production, 2014-2022

Data Source: United States Geological Survey | Collated by Mengersi

Development of China's Titanium Industry

China began research on titanium production processes in 1955 at the former Beijing Nonferrous Metals Research Institute. In 1958, the first batch of sponge titanium was produced on a laboratory scale with a furnace capacity of 10 kg. By 1959, small-scale production of 100 kg per furnace was achieved at the Fushun Aluminum Plant, laying the foundation for China’s sponge titanium production.

Today, among the three major titanium products in China, titanium dioxide has the highest output, reaching 3.79 million tons in 2021. In contrast, titanium processed materials—used in the most demanding downstream applications—have a relatively limited annual output. Currently, China’s titanium industry is facing structural overcapacity: high-end titanium materials for aerospace remain in short supply, while production capacity for civilian high-end titanium is insufficient and there is a serious surplus in the low- and mid-end segments.

Since 2017, driven by growing demand in high-end chemical, aerospace, marine, and power industries, the demand for titanium processed materials in China has hit record highs. In 2021, domestic sales reached 114,700 tons, a year-on-year increase of 35.8%. Of this, demand for titanium in mid- to high-end fields such as PTA-based chemical applications, aerospace, shipbuilding, and offshore engineering increased by 20,542 tons, up 28.5% year-on-year.

As titanium processing technologies in China continue to improve, downstream application scenarios are expanding. The output of both sponge titanium and processed titanium materials has increased significantly, and orders have become more stable. It is expected that production will continue to rise steadily in the coming years, and the competitive landscape of the titanium industry may undergo a new round of reshuffling.

The titanium industry value chain in China comprises five main stages: titanium ore → high-titanium slag → sponge titanium → titanium processed materials → high-end titanium products. Due to the complexity of production processes, China’s titanium processing industry is relatively concentrated. In 2021, the combined output of the top three producers accounted for 47.0% of the national total, while the top ten producers contributed 78.7%. The top three large-scale titanium producers alone contributed 44.7% of the total growth in titanium output, indicating further consolidation and a higher concentration in the titanium processing sector.

+86 512 68781993

+86 512 68781993