ADNOC announces a $20.7 billion energy infrastructure deal

Abu Dhabi, June 23, 2020 (WAM)

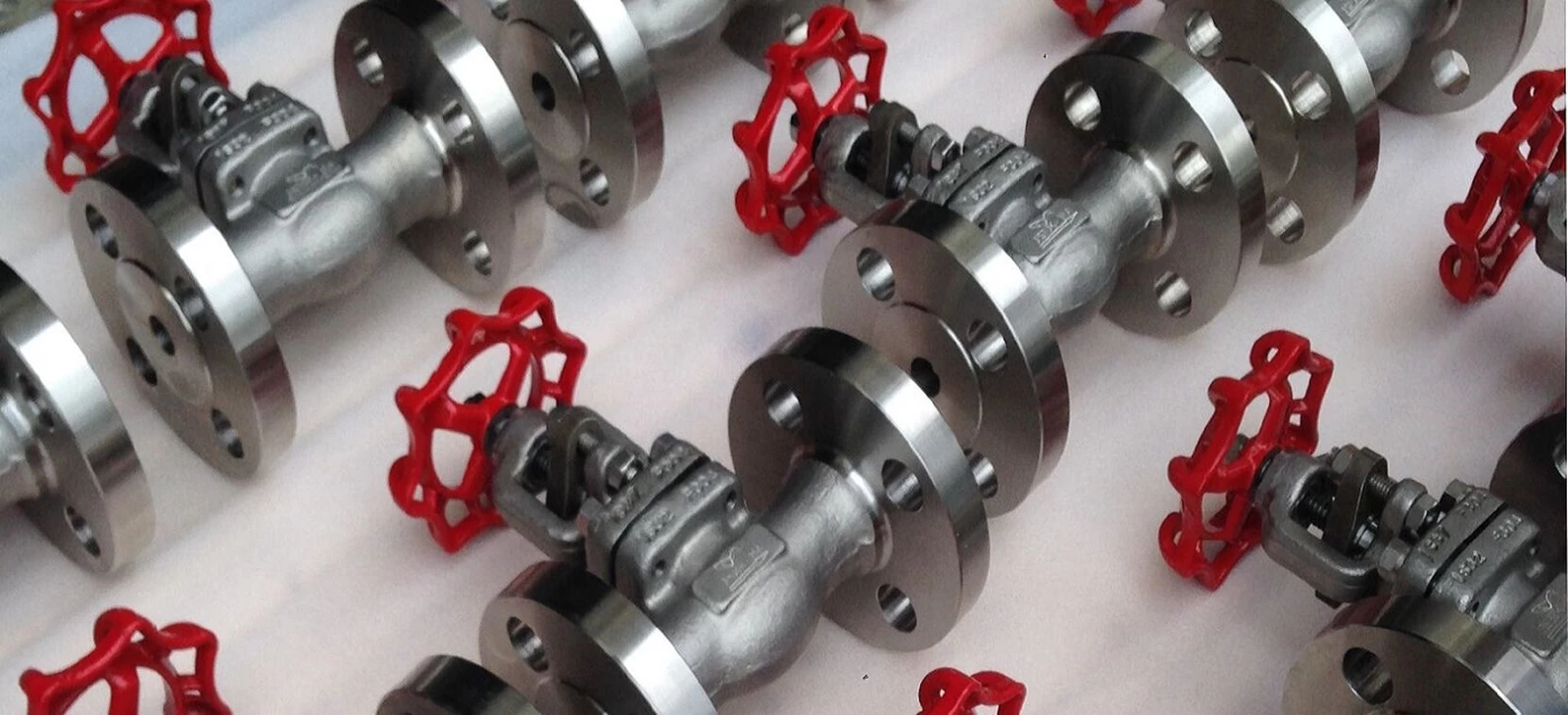

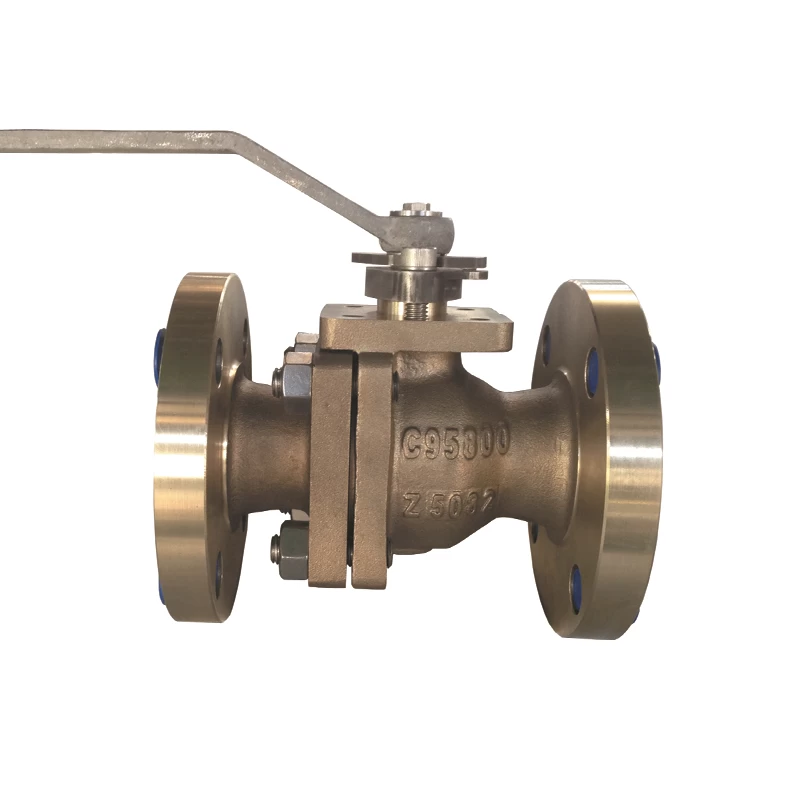

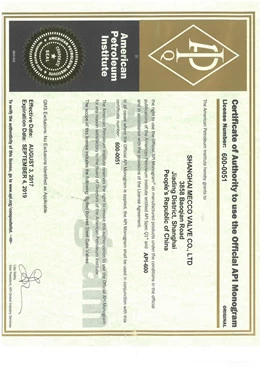

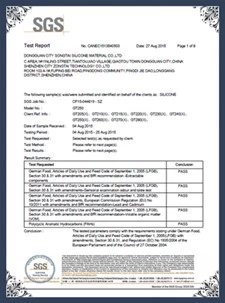

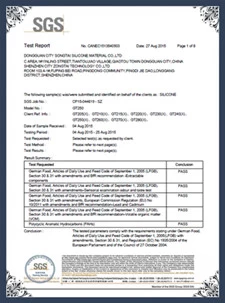

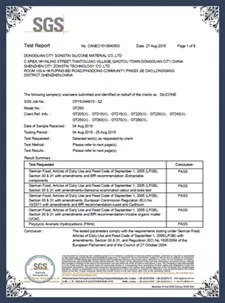

Abu Dhabi National Oil Company ADNOC announced today that it has signed agreements with some of the world's leading infrastructure investors and operators, sovereign wealth and pension funds. An investor consortium consisting of Global Infrastructure Partners (GIP), Singapore’s sovereign wealth fund GIC’s Brookfield Asset Management, the Ontario Teachers’ Pension Plan Committee, the Ontario Teachers’ Association, NH Investment & Securities and Snam will invest in selected ADNOC natural gas Pipeline assets, valued at USD 20.7 billion. In one of the world’s largest energy infrastructure transactions, the consortium will collectively acquire a 49% stake in ADNOC Natural Gas Pipeline Assets Co., Ltd. (hereinafter referred to as "ADNOC Natural Gas Pipeline"), a newly established subsidiary of ADNOC, which owns 38 pipelines Leasehold, with a total mileage of 982.3 kilometers, ADNOC holds a majority stake of 51% of the shares. The innovative transaction structure allows ADNOC to use the new global institutional investment capital pool while maintaining full operational control of assets that are part of the investment. According to the terms of the agreement, ADNOC will lease its ownership interest in the assets to the ADNOC natural gas pipeline for 20 years. In return, ADNOC will collect quantity-based tariffs according to certain lower and upper limits. The transaction will bring ADNOC more than US$10 billion in upfront revenue and must comply with customary closing conditions and regulatory approval. The natural gas pipeline network connects the upstream assets of ADNOC to local UAE offtakers. The products for gas pipeline network contains forged floating ball valve. All responsibility for pipeline ownership, pipeline operation management, and related operational and capital expenditures will be assumed by ADNOC. For ADNOC's partners, this transaction represents a unique opportunity to invest in high-quality energy infrastructure assets, and its low-risk characteristics can generate stable cash flow. Commenting on the deal, Dr. Sultan Bin Ahmed Sultan Jabir, Secretary of State and Chief Executive Officer of the ADNOC Group, said, "We are very pleased to work with some of the world’s leading global infrastructure and institutions Investor cooperation marks the region’s largest investment in energy infrastructure. This landmark transaction demonstrates the trust and confidence of the global investment community in ADNOC, and after the pioneering oil pipeline infrastructure investment partnership last year, Our pipeline portfolio has unleashed great value." Today’s landmark investment shows that people continue to have a strong interest in ADNOC’s low-risk, income-generating assets and establish a large-scale energy infrastructure investment in the UAE and the wider region. Another benchmark. This solidifies ADNOC's position as an attractive partner and strengthens the UAE's historical record as a destination for foreign direct investment in the region, even under the unprecedented current circumstances. "

Adebayo Ogunlesi, Chairman and Managing Partner of GIP, said: "We are very pleased to establish this strategic partnership with ADNOC, one of the world's leading energy companies. ADNOC's natural gas network is a core part of the UAE's midstream infrastructure and this transaction is an investment This quality and importance of assets provides unique opportunities while also supporting ADNOC’s smart growth strategy. This transaction highlights GIP’s strategy of investing in high-quality infrastructure assets and developing long-term strategic partnerships with industry leaders."

Bruce Flatt, CEO of Brookfield Asset Management, said: "We are very pleased to invest in this strategic pipeline system, which is between the UAE's low-cost natural gas supply and strong domestic demand. The key link."

"This transaction is in line with our strategy of investing in high-quality, important assets and generating stable and predictable cash flows in areas we are familiar with. ADNOC has become one of the world’s leading natural gas producers, with an operating record A model. We look forward to working with them to support this key asset and industry."

Ziad Hindo, Chief Investment Officer of the Ontario Teachers Corporation, said: "This strategic transaction is attractive to Ontario Teachers Corporation because it provides us with an equity stake in high-quality infrastructure assets and owns Stable long-term cash flow will help us meet our pension commitments."

"A new partnership with ADNOC and a group of world-class institutional and infrastructure investors has expanded our global business and provided further geographic diversification for our investment portfolio."

NH Investment&Securities Chairman and CEO Young Chae-Jeong said, "Investing in ADNOC’s natural gas infrastructure supports Abu Dhabi’s energy plan, strengthens our investment diversification strategy, and shows Korea’s influence in the global infrastructure sector The strength continues to increase. I believe that this landmark transaction can be a stepping stone to expand South Korea’s investment in the region."

Marco Alveré, CEO of Snam, said: "Through this strategic transaction, we have entered a country and region that is critical to our industry, thereby strengthening our international footprint. Our goal is to promote Further cooperation opportunities, especially in the area of energy transformation. We will use our industrial skills, know-how and innovative solutions in natural gas infrastructure management to work with ADNOC and consortium partners to contribute to the UAE’s energy system . This transaction has been conducted remotely in the past few months, proving our company's resilience and willingness to continue its growth path."

This is the largest transaction since ADNOC announced the expansion of partnership and investment model in 2017, and aims to create value for ADNOC. Since then, ADNOC has entered the debt capital market for the first time and issued 3 billion US dollars of bonds backed by the Abu Dhabi crude oil pipeline; ADNOC distribution is partially listed, which is the first IPO of the ADNOC group of companies; and has established in its drilling, refining, fertilizer and trading operations One of several strategic partnerships. These transactions and today's landmark announcement are part of ADNOC's continuous delivery of its value creation strategy. This landmark agreement strengthens the focus and catalyst of Abu Dhabi and the UAE’s responsible and continuous investment and value creation during this challenging period. This partnership has released a lot of capital and can be used to support the strategic initiatives of ADNOC's smart growth strategy. This strategic joint venture will enable ADNOC to pay a volume-based tariff to the ADNOC natural gas pipeline for the sale of natural gas and natural gas liquefied gas from ADNOC’s upstream assets to Abu Dhabi’s main exports and terminals. Tariffs will be charged based on the total transportation volume through the pipeline as well as liquefied natural gas, liquefied natural gas and flow, subject to a cap on capacity. The new subsidiary will issue 100% free cash to investors in the form of quarterly dividends. Bank of America Securities, First Abu Dhabi Bank and Mizuho Securities acted as financial advisers to ADNOC, while Moelis & Company served as independent financial advisers to ADNOC. The UAE has the sixth largest natural gas reserves in the world. ADNOC's natural gas strategy aims to meet domestic natural gas demand and support the UAE to achieve natural gas self-sufficiency. The dynamics of the UAE's natural gas market are attractive. In addition to the demand created by ADNOC's own upstream and downstream activities, it is mainly driven by domestic utilities and growing industrial production. ADNOC has responsible oil and gas production and a long-term commitment to environmental management. Cowinns is working on high pressure floating ball valve project with ADNOC.Earlier this year, the company announced a comprehensive set of sustainable development goals, including plans to reduce its greenhouse gases, greenhouse gases, and emission intensity by 25% by 2030, strengthening it as the world’s lowest carbon intensive oil and gas company One of the status.

+86 512 68781993

+86 512 68781993